In the rapid race to modernize insurance analytics using artificial intelligence (AI), the industry narrative is often dominated by speed. Insurers are investing heavily in faster data ingestion, real-time insights, and automated decisioning platforms to gain a competitive edge. Yet, while speed is crucial, it is not the ultimate measure of success. The defining differentiator for insurers in 2026 and beyond will be how confidently and ethically humans can act upon these swift insights.

As automation accelerates, a compelling challenge emerges: how to ensure that rapid analytics do not undermine trust, blur understanding, or eclipse the essential human judgment required to navigate complex claims and underwriting decisions. The future belongs to those who integrate speed with wisdom, creating analytics systems that empower rather than replace human expertise.

Why Analytics Projects Fail When They Ignore Human Context

Despite advancements in AI and data science, many analytics initiatives falter because they underestimate the fundamental role of human context in decision making.

Common causes of failure include:

- A disproportionate focus on developing highly sophisticated algorithms without sufficient attention to how decision-makers interpret and use the insights day-to-day.

- Deployment of tools that generate insights or reports quickly, yet users lack the confidence or domain knowledge to make decisions based on those outputs, resulting in disregard or misapplication.

- Minimal collaboration between data scientists and the front-line experts—such as claims adjusters and underwriters—whose tacit knowledge is critical for contextual interpretation.

McKinsey’s 2025 analysis stresses that superior AI model performance alone does not translate into business value unless paired with human-centered design that closes the “last mile” to practical decisioning and judgment.

Without this grounding, organizations endure mistimed decisions, operational risks, and eroding customer trust—problems that worsen as speed increases without understanding.

The “Judgment Gap”: When Speed Without Understanding Leads to Risk

This disconnect between rapid, automated insights and cautious, thoughtful human judgment is what experts call the “judgment gap.” It is the vulnerable space where decision velocity outpaces decision quality.

Typical manifestations of the judgment gap include:

- Claims flagged by AI algorithms as suspicious with little to no explanation, frustrating customers due to unnecessary investigations or delays.

- Automated underwriting declines provided without clear reasoning, leading to contentious appeals and customer churn.

- Overreliance on opaque “black-box” AI models that may misfire in rare or edge-case scenarios, where human expertise is irreplaceable.

This gap is not a minor inconvenience—it carries material operational and reputational risks. Leaders must confront this silent liability head-on by building workflows and analytics systems designed to amplify human judgment rather than replace it outright.

Building Human-Centered Analytics Systems

In response, forward-thinking insurers are pioneering what we term Human-Centered Analytics—platforms and processes that prioritize not only speed but transparency, empathy, and collaboration.

Core principles of this approach include:

- Co-designing analytics tools with end users: Front-line experts such as claims adjusters, underwriters, and risk managers actively participate in tool development. Their feedback ensures relevance, usability, and alignment with real-world workflows.

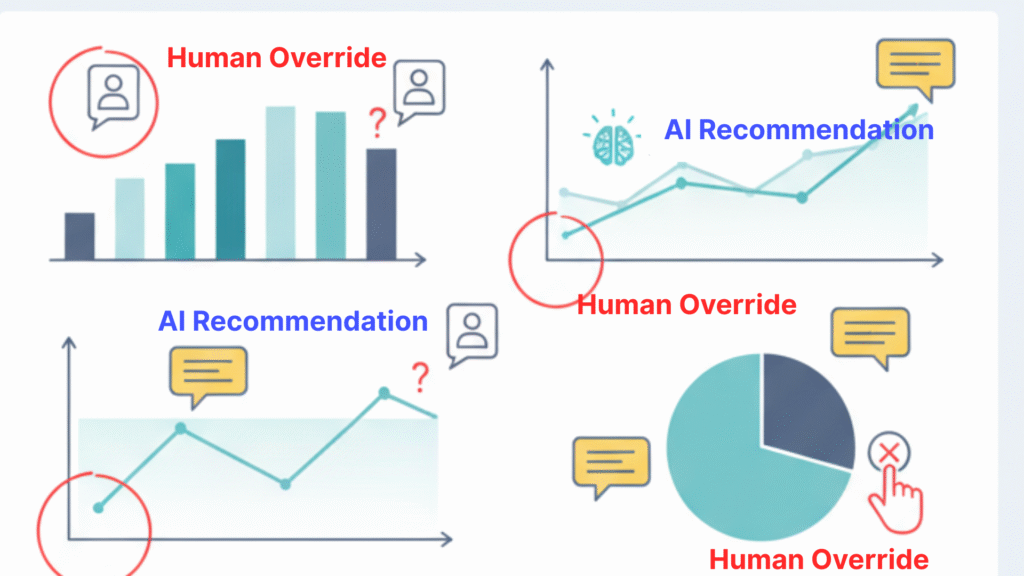

- Embedding explainable AI (XAI): Models are designed to provide clear rationales alongside predictions, enabling users to understand strengths, limitations, and uncertainties. This empowerment builds trust and encourages informed overrides where necessary.

- Creating integrated decision dashboards: Tools merge AI predictions with qualitative annotations and real-time human inputs, enriching the data narrative for more nuanced decisions.

- Providing continuous training: Teams are equipped not just to operate systems but to critically interpret analytics. They learn to balance algorithmic outputs with domain wisdom continuously.

For instance, UK insurer Aviva has successfully implemented over 80 AI models spanning claims triage, routing, and fraud detection. Beyond technological prowess, their gains—such as a 30% increase in claim routing accuracy and a 65% reduction in customer complaints—stemmed largely from embedding robust human validation points and iterative feedback loops throughout AI pipelines.

Automation is only as valuable as the confidence it enables. That’s why top insurers are rebuilding workflows for trust.

Balancing Automation and Empathy in Claims Management

Claims management is uniquely human, involving sensitive customer interactions often amidst personal loss or hardship. While AI excels in automating routine checks and flagging anomalies, it cannot replace the empathic engagement matters most at critical moments.

An effective hybrid model involves:

- Using AI to automate administrative and investigative tasks like document verification, policy validation, and damage assessment swiftly and accurately.

- Empowering claims adjusters to dedicate their time to personalized customer engagement, complex disputes, and negotiations—cases requiring emotional intelligence, flexibility, and ethical judgment.

- Leveraging AI-driven communication tools that generate clear, context-sensitive messaging to customers, strengthening trust while reducing confusion or frustration caused by impersonal bureaucracy.

Deloitte’s 2025 insurance outlook highlights that this balanced approach leads to faster claim cycles without sacrificing customer satisfaction. In fact, insurers adopting human-AI collaboration record significantly lower complaint rates and higher repeat business, driven by the empathy baked into their workflows.

Read how insurers measure success through decision velocity.

The Three Pillars for Trustworthy Insurance Analytics

Creating trustworthy, human-centric analytics systems rests on three foundational pillars:

- Explainable AI

Models must be transparent and interpretable to both users and regulators. Explainability builds confidence by revealing how inputs map to outputs and highlighting potential bias or uncertainty. For example, when AI-driven fraud detection highlights suspicious claims, it should provide clear reasons—enabling adjusters to verify or override decisions responsibly. - Data Transparency

Users must have clarity on data provenance, accuracy, and freshness powering AI models. Transparent data governance prevents skepticism around “black box” outputs and supports compliance with regulations like GDPR or HIPAA—essential in insurance which faces strict privacy and fairness mandates. - Decision Accountability

AI cannot replace human responsibility. Clear policies defining decision ownership—when to escalate, override, or trust AI outputs—are critical. Continuous monitoring, audit trails, and governance structures reinforce oversight and ongoing learning.

These pillars are deeply interconnected and collectively create a foundation of ethics, trust, and operational excellence in AI-driven insurance analytics.

Read how AI is reshaping real-time decision-making in claims.

Leadership Takeaway: Amplify Judgment, Don’t Replace It

Veteran leaders transforming insurance analytics must embrace a human-centered paradigm where speed serves understanding—not the converse.

This calls for:

- Viewing AI and automation primarily as augmentation tools—freeing human experts to apply judgment and creativity to the most complex, consequential decisions.

- Prioritizing investments in user experience design, explainability technologies, and robust practitioner training programs.

- Leading a cultural shift toward collaborative human-AI decision-making, encouraging data scientists, claims specialists, and executives to co-create analytics workflows and outcomes.

By committing to these principles, insurers harness the power of real-time analytics while preserving ethical standards, regulatory compliance, and customer trust—the true currency of a sustainable competitive edge.